child tax portal update dependents

Those who care for more. You can qualify for the credit if your dependent meets the above requirements and your annual income does not exceed.

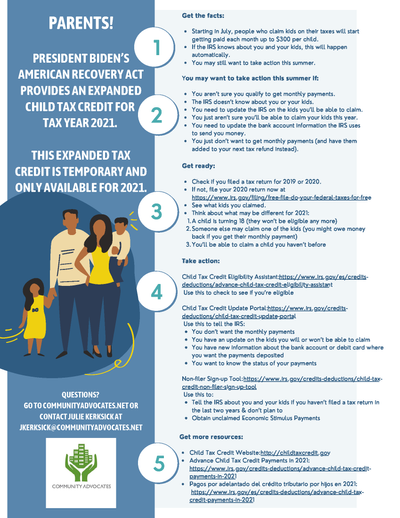

Child Tax Credit What We Do Community Advocates

The full monthly child tax credit benefit is eligible for incomes up to 75000 for individuals 112500 for heads of household and 150000 for married couples.

. Child tax credit portal update dependents Tuesday March 29 2022 To complete your 2021 tax return use the information in your online account. 150000 married filing jointly or qualifying widow or. You will answer the whole year.

How to sign up for the Child Tax Credit. The Child Tax Credit Update Portal can be used by families to update the information the IRS has for them that may make them eligible for the credit. Half of the money will come as six monthly payments and half as a 2021 tax credit.

150000 married filing jointly or qualifying widow or. The IRS will pay 3600 per child to parents of young children up to age five. Child Tax Credit Changes.

The IRS will pay 3600 per child to parents of young children up to age five. Half of the money will come as six monthly payments and half as a 2021 tax credit. At some point the portal will.

You can qualify for the credit if your dependent meets the above requirements and your annual income does not exceed. The IRS recently upgraded the Child Tax Credit Update Portal to enable families to update their bank account information so they can receive their monthly Child Tax Credit. Child tax credit portal update dependents Tuesday March 29 2022 To complete your 2021 tax return use the information in your online account.

Since on your 2020 tax return the Child. This one change will move that little check mark from Credit for other dependents to Child tax credit. Child tax portal update dependents Thursday October 13 2022 Edit The IRS recently upgraded the Child Tax Credit Update Portal to enable families to update their bank.

The IRS will add more features. The IRS is yet to release any information about when it will be possible to update dependent details on the portal. The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 for qualifying children under the age of 6 and to 3000 per child.

The IRS will pay 3600 per child to parents of young children up to age five. Families can now report income changes using the Child Tax Credit Update Portal.

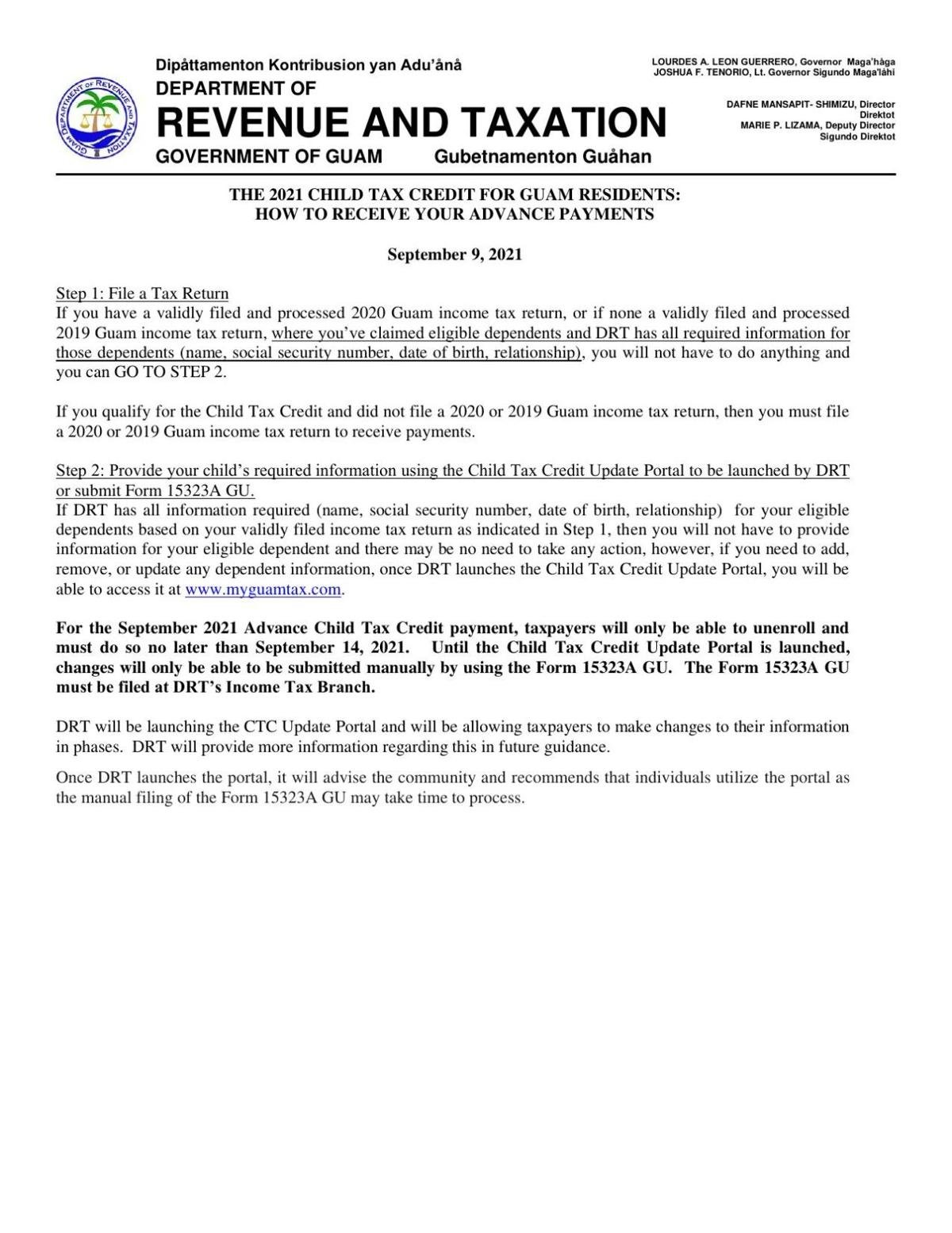

How To Receive Your Payments Guam News Postguam Com

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

What To Know About The First Advance Child Tax Credit Payment

/cdn.vox-cdn.com/uploads/chorus_asset/file/22733126/1233995610.jpg)

How To Get The Child Tax Credit And Why It Should Be Easier To Get Vox

Usa Finance And Payments Gas Stimulus Check Tax Deadline Child Tax Credit Portal 4 April As Usa

What To Do If You Got An Incorrect Child Tax Credit Letter From The Irs

How To Get The Advance Child Tax Kandit News Group Facebook

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

White House Unveils Updated Child Tax Credit Portal For Eligible Families

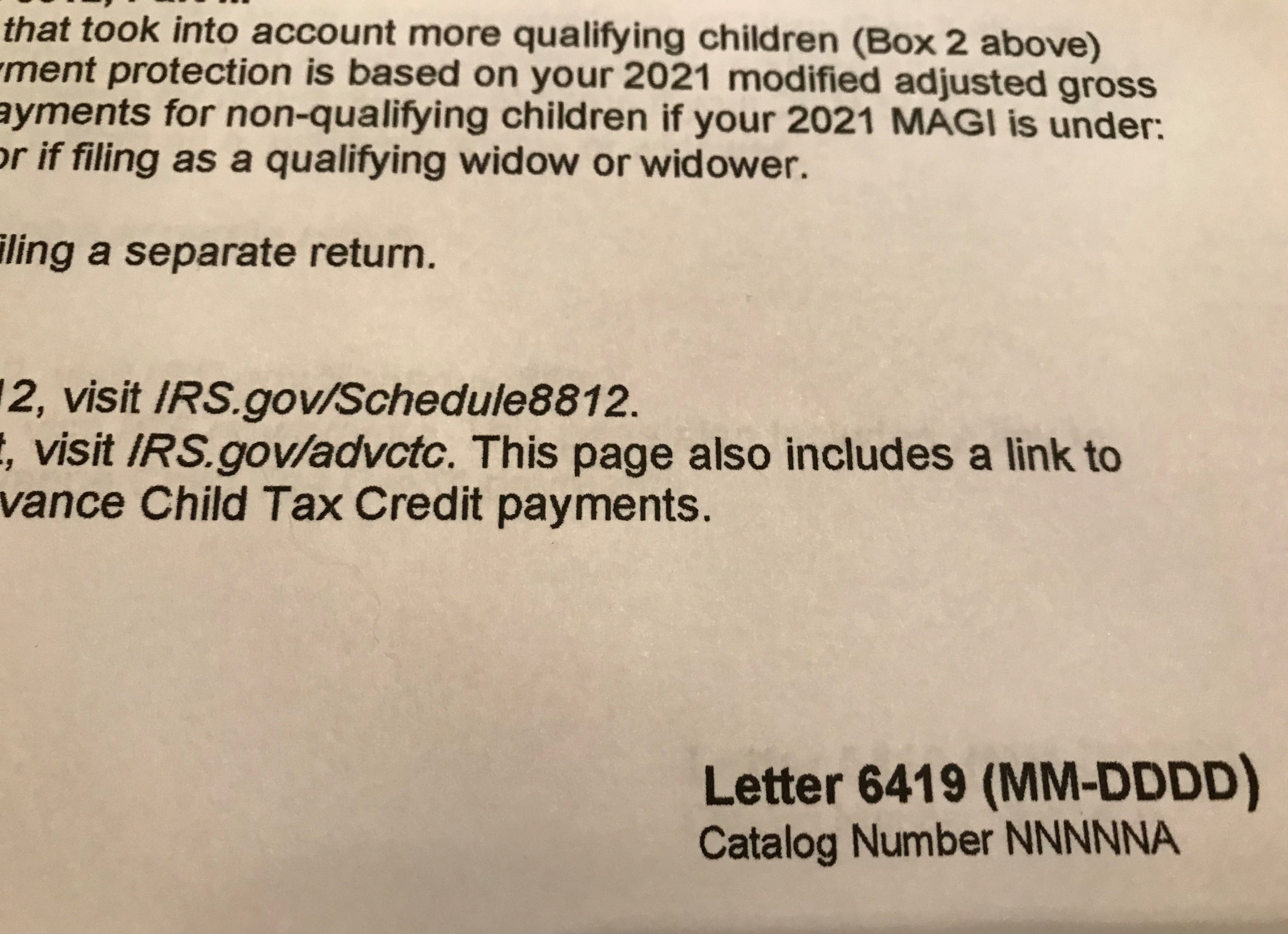

Irs Letter 6419 For Child Tax Credit May Have Inaccurate Information

How To Apply For The Child Tax Credit With The Irs Non Filer Sign Up Tool Youtube

How The 2021 Child Tax Credits Work Updated June 21st 2021 The Learning Experience

Child Tax Credit To Being In July Youtube

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

What Divorced Or Separated Parents Need To Know About Child Tax Credits Elmhurst Family Law Attorney

Five Facts About The New Advance Child Tax Credit

/cloudfront-us-east-1.images.arcpublishing.com/gray/ZMKNLBZWRJDNXJOLDBQSHYZB3Y.jpg)